Okay, here’s a riddle for you: What’s valuable and great to have but hard to keep? If you guessed me, you’re correct. Kidding (sort of), I’m talking about paper, moolah, funds…I totally Googled “slang terms for money” and one of them that came up was “dead presidents” which seems a little dark. Does anyone actually use that term? “Yo, man, I made so many dead presidents from working overtime!”

I’m done trying to be cool now. This post is all about being money smart in college. It’s really easy to be careless in college when it comes to things like doing laundry, eating properly or skipping class but none of those things are quite as serious as learning to be smart with your money!

1. Make your purchases intense. Be a little harsh to yourself.

Blah blah, yeah it’s important to love yourself and treat yourself kindly, like, how many articles have you seen encouraging you to “Treat Yo Self” while injecting a cliche GIF from Parks & Rec? A lot. Now is not the time to treat yourself. Play bad cop! Give yourself tough love before you make a purchase! Look yourself in the mirror and ask yourself the hard-hitting questions:

Do I own something similar already? If so, why is this one any different? Is the difference worth buying another one?

I own eight pairs of black boots. Each time I convinced myself “This pair is different! These have a bigger heel and studs!” I played myself. Don’t play yourself. Really think about if these items are similar and if they have a difference, is the difference worth the price? Spoiler: studs aren’t worth it if they’re the only difference.

How many times will you actually use it? Could you just borrow it from someone else?

If you need a white dress just to wear to a costume party, consider borrowing one instead. Making a bundt cake for some reason? Borrow a pan and don’t buy one unless you bake all of the time. If it’s something you’ll only wear or use once, don’t buy it if you can borrow it or substitute it for something you already have.

Am I buying it because it’s on sale/a good deal?

I’m the worst at this. Forever 21 is my weakness. Do I need new dresses and crop tops? No. Do I need new dresses and crop tops that are $10?! Yes. It’s always yes. I need to stop. Don’t do what I do.

Don’t buy something just because it’s a good deal, you’re not on a TLC reality show about great deals and no one cares how great of a deal you got. Your wallet is the only one tuning in to this show and she (or he) is not pleased.

If you’re really great at kidding yourself (ahem, me), ask a trusty no B.S. friend to answer these questions for you. My no-nonsense roommate has saved me from making a ton of bad purchases such as the time I convinced myself I needed emerald green lipstick and she quickly reminded me that I had blue lipstick I didn’t even wear and no need for green lipstick even if it meant getting free shipping.

2. Split costs.

This is especially important if you’re living with a bunch of people or often find yourself splitting tabs, meals, rent and bills with friends. Using Venmo is a great way to do this without being awkward or forgetting who owes what. You also don’t need to feel obligated to just pay all of a bill just to make things easier because Venmo is easy.

It’s very easy to have someone say, “Oh, I’ll pay my share of the electricity bill after my paycheck. Can you cover me?” and then promptly have all parties forget that any money was owed. By “forget” I mean just never actually pay you back even if they remember. Venmo allows you to pay using your bank, credit card or debit card so there’s no excuse if your friend doesn’t have cash on them.

3. Use PayPal.

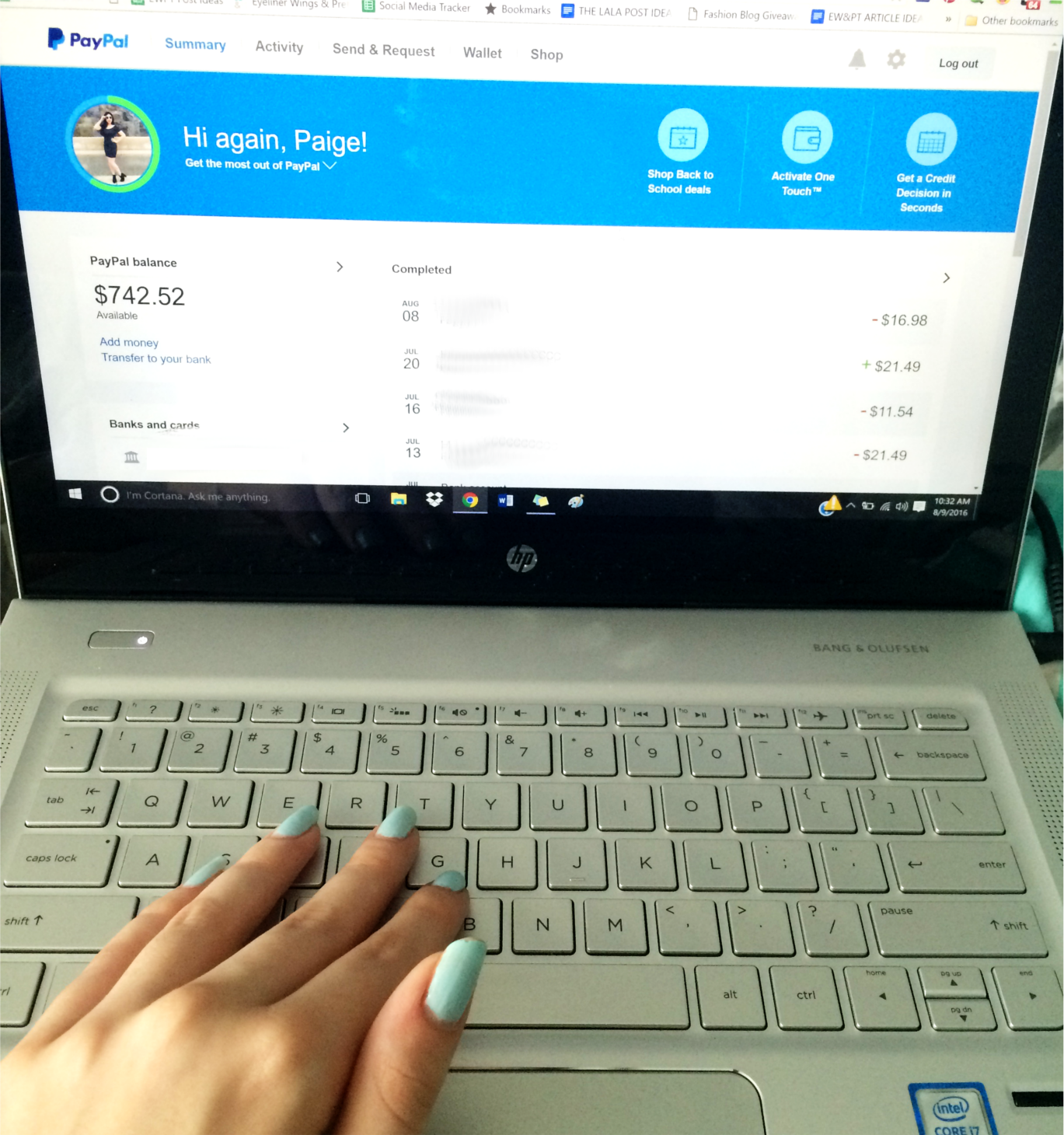

PayPal is my favorite thing for multiple reasons. First of all, I feel a lot safer making online purchases through PayPal because there’s no risk of your credit card information being stolen, which is a huge fear of mine. I’m always convinced after each online purchase that this is it, this is the day my identity is stolen. I’m clearly a paranoid person and PayPal helps me not be one.

{ Related: The Ultimate Guide to Being Safe In College }

Secondly, PayPal has an app and a website that shows you all of your transactions. Like, it shows me where I just spent money and how much I spent. This is a huge wake up call and I think twice about my purchases when I use PayPal. This also shows you where money is coming in, which personally helps because my internship and blogging sponsorships use PayPal and this allows me to keep track of dates and numbers.

Third of all, you can control how much money you put on PayPal. If you want to budget yourself $100 to spend on clothes and fun stuff, put that amount on PayPal and you literally can’t spend more than that. This is a unique way to control your spending habits.

Lastly, you can earn some good karma and be a good Samaritan with the PayPal Giving Fund, where 100% of proceeds go to selected partnering charity organizations, such as Let Girls Learn, YMCA and Boys & Girls Clubs of America. While donating money seems counter-intuitive when you’re trying to save, kindness never hurts.

4. Don’t order food or eat out as much.

Duh, right? Ordering food and eating out at a restaurant is easy to do in college when you’re lazy as hell and pizza at 2 AM is always a good idea. Delivery fees, tips and other things can add up. Did you know you can buy an entire pack of ravioli and jar of sauce for $6 that can last you around two meals versus spending $13 + tax and tip for a ravioli entree at a restaurant for one meal? Think about that.

Even if you hate cooking or don’t want to do it, you can literally buy pre-cooked meals. They’re not always the cheapest but they’re generally cheaper than ordering food and you can cook them faster than it’ll take for your food to be delivered.

5. Avoid those friends who are always big spenders.

I feel like every college student has a friend who doesn’t leave the mall without making at least three purchases, orders food every night and seems to have an unlimited flow of cash. This friend is also commonly the one encouraging you to “Treat yourself!” while exclaiming, “That looks so good on you, you have to buy it! You need that!”

This friendship doesn’t need to end, but avoid accompanying said friend to daily Starbucks runs and trips to the mall. Personally, when my friends are spending money I feel more inclined to make purchases.

If you want to distract yourself from spending, why not swap your role a little? One of my favorite past-times is half-jokingly convincing my friends they need to buy things such as sparkly glitter bath bombs from LUSH or ugly sweater tank tops (They don’t make SENSE!). Have fun and live vicariously through the spending of others, right? Okay, I can feel you judging me. I’m giving you advice on being money smart in college, not on being a good friend with good karma vibes.

6. Figure out where you’re spending the most money and squash the temptation.

Poorly Informed Dating Tip That’s Actually A Good Financial Tip: Play hard to get!

Personally, PayPal helps me with this. Remember how I mentioned you can track your transactions on here? After scrolling through my transaction history I discovered that most of my income was being spent on cosmetics. Yikes. Now that I know this, I’ve unsubscribed from Sephora and ULTA emails on my main account and moved it to my side-chick sort of email. My sidechick email is the email I made in middle school but can’t bear to part with so I get most of my company and shopping emails sent there.

By getting all of the offers and deals sent to another email, I’m avoiding the temptation to give in to the free shipping offer. Free shipping is the BOMB and it’s my biggest weakness. Now, if I want to shop, I have to actively go on my other email account and by the time I do this, I’ll probably talk myself out of spending.

Play hard to get with your common places of spending. If you find yourself buying coffee every morning at Starbucks, brush your teeth right before you leave so you’re not tempted to ruin your breath or bring your own coffee from home. Unsubscribing from newsletters or avoiding these temptations make it easier not to give in to spending. Learn what triggers you to spend (email newsletters? free shipping? passing the shop on your way home?) and avoid, avoid, avoid!

7. Set money aside.

I’m not your dad who’s going to tell you to set aside 15% of your paycheck for your future or something (although that’s not a bad idea). I am going to tell you that you should set aside bits of your paycheck for specific things. If you know you’re going to have to spend a good chunk of change on something in the future start putting aside money so when the time comes you won’t be rushing to scrape the money together.

For example, in August I start setting aside a little bit of each paycheck towards Christmas gifts so by the time December rolls around, I won’t have to worry about coming up with present money. This is perfect if you’re planning on studying abroad, making a large purchase or have a friend’s birthday coming up.

Pssst…if you need some gift ideas for your college friends, check out my college girl’s ultimate gift guide!

8. Learn how to say no.

If your friends want to go out or order food, it’s okay to say no. It can be awkward and it can suck opting out of certain things because you’re low on funds but this is college. Most students are low on funds. When saying no you can leave it simply with no.

You can suggest an alternative as well. Friends want to order pizza? Suggest making homemade pizza. Friends want to see a movie? Suggest having a movie night in instead. You can easily make it light-hearted and funny. Most college students find the broke college student cliche to be relatable. Embrace it. Joke about it. Be honest.

“What do you call someone with two thumbs and no funds?” *finger guns aimed at yourself* “This gal!”

9. Join loyalty and rewards programs.

A lot of stores and coffee shops offer rewards for spending a lot. Starbucks, CVS, and Rite-Aid are some places that have them, Michael’s craft store is another. If there’s a place you frequent, see if they have some sort of rewards or loyalty programs. Most of the time they’re free to join and you can earn points or coupons.

I was playing around on the PayPal app and actually realized you can actually keep track of your loyalty cards on their app! This is great if you don’t feel like carrying your loyalty cards with you or often forget them. Everything’s digital these days, embrace it.

10. Utilize seasonal deals.

You don’t need to participate in the hell hole that is Black Friday, but Cyber Monday is always a great time for deals. Purchase things at the end of the season if you can! Swimsuits are always really inexpensive when summer is ending and winter coats are cheapest when winter’s ending, too.

Additionally, back to school season has a ton of great deals. Plus back to school shopping is generally better than back to school. PayPal in particular has partnered with a bunch of retailers to bring some back to school deals which you can find here.

11. Pay back what you borrow and get back what is owed to you.

Make this a priority! Like I mentioned, this can be done through PayPal or Venmo if it makes it easier. If you borrow money from someone, pay it back ASAP. Don’t be that jerk who never pays anyone back. If someone lends me any amount of money, even $1, I pay it back ASAP or cover for them next time we get coffee together or lunch if it’s a comparable amount. A huge pet peeve of mine is people who borrow things and don’t give them back unless it’s explicitly stated that these things don’t need to be returned.

If you lent money to someone with the intent of getting it back, give them a gentle reminder. It can be awkward and difficult but giving a reason for the sudden interest in getting repaid can make it easier. This can be something as simple as, “Hey! I know I lent you $20 a while ago for drinks but I need some cash for a birthday gift!Would you be able to pay me back this week?” You can also use the PayPal “Request Money” feature if you want to gently shove them in a non-confrontational but slightly passive aggressive manner.

Furthermore, if you know your friend never pays anyone back, don’t lend them cash.

12. Before you order, scour the web for coupons and sale dates.

I never buy anything from Michael’s without 20% off. Coupons can easily be pulled up from their website and this is the case for a lot of stores! Simply Google “*STORE NAME* coupons” before you order online or shop in store. It really can’t hurt and you often can find a 10%-15% off deal.

On this same note, keep note of semi-annual sales. Some places like Nordstrom and Bath & Body Works are notorious for their huge sales. Mark those dates on your calendars and wait until then to shop! They’re usually around the same time every year.

What are your tips for being money smart in college?

I was selected for this opportunity as a member of Clever Girls and the content and opinions expressed here are all my own.

THIS WAS AMAZING!! I’m so bad with spending money. Like I know I should and my parents always tell me to but when I want something, I want something. I’ll go online EVERYWHERE and look for the cheapest deal out there and all the coupons I can get. But seriously, this post will come in handy to so many people.

Isabelle | TrulyIndulgent.com

Thank you so much Isabelle!! Oh man, when I buy things I research sooo many coupons and deals just to make sure I’m not missing out on free shipping or something haha